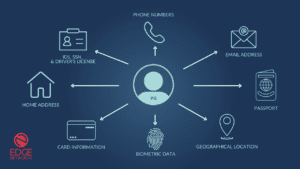

Protecting Personally Identifiable Information (PII)

One thing is clear: protecting Personally Identifiable Information (PII) is critical. Just imagine the consequences if sensitive information, such as bank account details, credit card information, or investment portfolios were to fall into the wrong hands. The results would be devastating, ranging from severe financial loss and identity theft to irreparable damage to an organization’s reputation and trustworthiness.

Any organization that handles personally identifiable information (PII) plays a key role in ensuring the confidentiality, integrity, and availability of it. A study by Experian found that two-thirds (64%) of consumers said they would be discouraged from using a company’s services following a data breach. By implementing strong security protocols, leveraging advanced encryption technologies, meeting all necessary regulations, and creating a culture of cybersecurity, organizations that handle PII can improve their cyber resilience. It can also help build more trust among customers, partners, and stakeholders.

Common Attack Techniques on Personally Identifiable Information

Cyber threats are increasingly targeting financial data and continue to evolve at an alarming rate. Attackers are becoming increasingly sophisticated, employing advanced tactics such as social engineering, malware, ransomware, and phishing schemes to exploit unsuspecting victims. No organization is safe; these threats aren’t limited to a specific industry or type of financial transaction, so it’s essential to be vigilant and proactive in your approach to data security.

To effectively protect PII, it’s critical to know and be able to identify the common attack techniques used by cybercriminals. Here are a few of the most common methods used to target financial information:

- Phishing Attacks: Cybercriminals often use deceptive emails, messages, or websites to trick individuals into divulging their login credentials, credit card details, or other sensitive information. These phishing attempts are designed to appear legitimate, making it imperative to exercise caution when sharing personal data online. They are also becoming increasingly difficult to spot with the integration of ai.

- Malware: Malicious software, such as keyloggers or banking Trojans, can be unknowingly installed on a user’s device, allowing cybercriminals to intercept sensitive financial information. Malware can be distributed through infected attachments, compromised websites, or deceptive downloads, highlighting the importance of robust antivirus and anti-malware solutions.

- Insider Threats: While external threats often dominate discussions on cybersecurity, internal risks cannot be overlooked. Insider threats occur when employees with authorized access to financial data misuse or leak it intentionally or unintentionally. Implementing strict access controls and fostering a culture of security awareness can help mitigate such risks.

Consequences of Data Breaches on Personally Identifiable Information (PII)

The consequences of data breaches in the financial industry can be far-reaching and devastating. Here are some potential ramifications that individuals and organizations may face:

- Financial Loss: Data breaches can result in immediate financial losses for individuals whose accounts are compromised. Unauthorized transactions, fraudulent charges, or identity theft can significantly impact personal finances. For businesses, the costs associated with data breaches include legal fees, regulatory penalties, remediation expenses, and reputational damage.

- Reputation Damage: Trust is the foundation of the financial industry, and a data breach can erode that trust. Customers may lose confidence in financial institutions or fintech companies that fail to protect their sensitive PII, leading to reputational damage and potential loss of business.

- Regulatory Non-Compliance: The financial industry is subject to strict regulatory requirements for protecting PII. A data breach can expose organizations to non-compliance with regulations such as the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS), resulting in legal consequences and significant financial penalties.

Understanding the evolving threat landscape, staying educated, and recognizing the potential consequences of data breaches are crucial for protecting sensitive PII.

5 Tips for Protecting Personally Identifiable Information (PII)

1. Implementing Strong Access Controls

To safeguard PII, implementing strong access controls is critical. A strong password is the first line of defense against unauthorized access. It should include a combination of letters, numbers, and symbols. We recommend using a password manager, which securely stores and generates complex passwords. Password managers simplify managing multiple passwords, making it easier to maintain strong and unique credentials for each account. Multi-factor authentication (MFA) can add an extra layer of security to your account. MFA requires users to provide additional verification, such as a unique code sent to their mobile device and their password.

2. Encryption and Data Protection

Data encryption is a vital component of protecting sensitive financial information. Encryption is the process of converting data into a coded form that can only be accessed with an encryption key. It ensures that even if data is intercepted, it remains unreadable and unusable. Whether stored on local devices, cloud servers or being transmitted between systems, encryption provides additional protection against unauthorized access.

3. Employee Training and Awareness

Employees are often the first line of defense against cyber threats. Educate and empower them to recognize phishing attempts, avoid suspicious links or attachments, and practice safe online browsing. Conduct regular security awareness programs and tabletop exercises and promote a culture at your organization that values data security by integrating it into company policies, procedures, and day-to-day operations. To minimize the impact on sensitive financial data, encourage your employees to report incidents promptly.

4. Regular Software Updates and Patching

Keeping software and systems up to date is crucial for maintaining a secure environment. Outdated software often contains vulnerabilities that cybercriminals can exploit. Regularly updating operating systems, applications, and firmware is essential to address security flaws and protect against known exploits. Remember to always enable automatic updates whenever possible and apply patches promptly.

5. Network Security Measures

Protecting PII requires robust network security measures, such as firewalls, which are a barrier between internal networks and external threats, and intrusion detection systems, which monitor network tragic for suspicious activity.

Implementing these security measures is critical in helping detect and prevent unauthorized access to financial data. We also recommend using virtual private networks (VPNs) when accessing sensitive data remotely to ensure secure communication.

By integrating these best practices for protecting sensitive financial data, individuals and organizations can significantly enhance their security posture.

Compliance and Regulatory Considerations

The financial industry operates within a framework of regulatory requirements aimed at protecting sensitive data. Some key compliance regulations include:

- General Data Protection Regulation (GDPR): The GDPR sets data protection and privacy standards for individuals within the European Union (EU). It applies to organizations that process the personal data of EU citizens, regardless of their geographical location.

- Payment Card Industry Data Security Standard (PCI DSS): PCI DSS is a set of security standards developed to ensure the secure handling of credit card information. It applies to organizations that process, store, or transmit credit card data.

Regulatory standards often require organizations to implement robust security measures and best practices. By adhering to these standards, organizations improve their data security posture, reducing the risk of data breaches and cyber-attacks. Adhering to these standards for data protection is necessary to establish customer trust, mitigate legal and reputational risks, and enhance your organization’s overall data security practices.

Consequences of Non-Compliance with Industry Regulations

It is crucial for organizations in the financial industry to prioritize compliance with regulatory requirements to mitigate these potential consequences. By aligning their practices with regulatory standards, organizations can protect sensitive financial data, enhance their overall security posture, and maintain the trust of their customers.

Non-compliance with industry regulations can have significant repercussions for organizations:

- Financial Penalties: Regulatory bodies can impose substantial non-compliance fines, which can amount to millions of dollars, depending on the severity of the violation and the regulatory framework in place.

- Legal Consequences: Non-compliance may result in legal action, including civil lawsuits and prosecution. Organizations that fail to meet regulatory obligations may face legal proceedings, which can be costly and time-consuming.

- Reputational Damage: An organization’s reputation can be easily tarnished and lose customer trust and loyalty. Negative publicity surrounding data breaches or privacy violations can have long-lasting effects on the perception of the organization and its brand.

- Business Disruption: Business disruptions are common with non-compliance, such as temporary suspension of operations or limitations on the organization’s ability to conduct certain activities. This can result in financial losses and hinder the organization’s growth and competitiveness.

The Fundamental Responsibility of Protecting Personally Identifiable Information (PII)

Protecting personally identifiable information (PII) is not just a legal obligation but a responsibility that organizations and individuals have. The financial industry relies on the trust and confidence of customers, and the security of their financial information is critical.

It requires a proactive and comprehensive approach, though. Organizations can significantly enhance their data security posture by implementing strong access controls, utilizing encryption and data protection measures, prioritizing employee training and awareness, keeping software and systems up to date, and deploying network security measures. If this all seems overwhelming for you, contact us, and we can guide you on your journey to strong cybersecurity.